Commercial mortgage calculator how much can i borrow

The rule states that your mortgage should be no more than 28 percent of your total monthly gross income and no more than 36 percent of your total debt. How accurate is the car lease calculator.

How To Secure Commercial Property Mortgage In Australia Commercial Property Commercial Real Estate Commercial Loans

A mortgage broker can help you get approved and borrow the amount you need.

. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. For example the 2836 rule may help you decide how much to spend on a home. How much can I borrow with an accounting practice commercial loan.

After performing the calculation you can transfer the results to our mortgage comparison calculator where you can compare all the latest mortgage rates. The bank or lender still has the final decision about how much you can borrow and at what rate. Depending on how large the property is and how what type of property is being acquired at closing the appraisal can quickly accumulate several hundred dollars of hidden or unforeseen costs.

To use our mortgage affordability calculator simply enter your and your partners income or your co-applicants income as well as your living costs and debt. Using a percentage of your income can help determine how much house you can afford. Gifts or loans from relatives and programs like an 801010 combination loan can help you avoid PMI.

The loan is secured on the borrowers property through a process. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. To calculate how much you can qualify for use our mortgage affordability calculator.

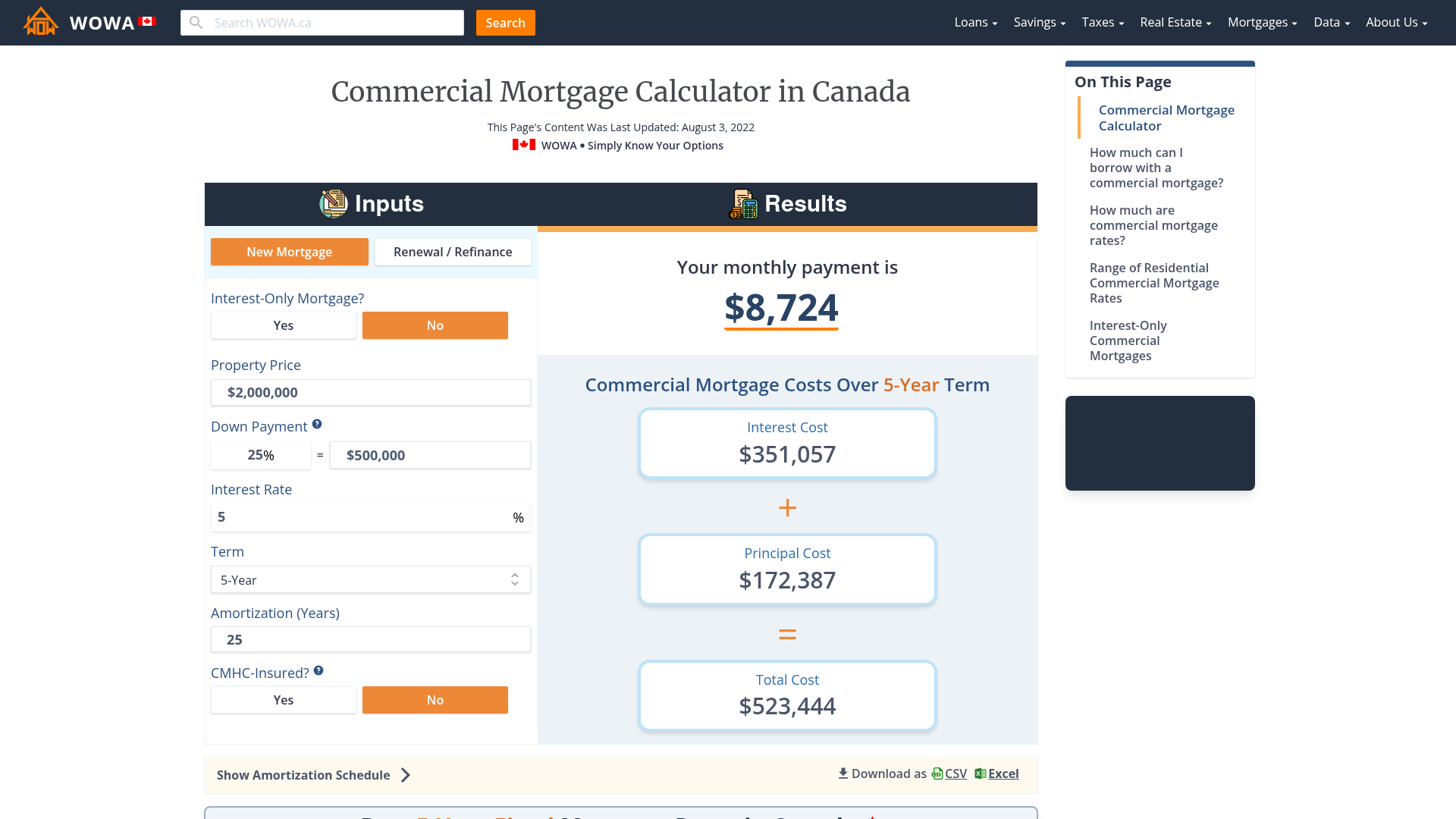

Using our calculator on top lets estimate mortgage payments with the following example. Most commercial mortgage amounts range between 150000 and 5000000. Loan to Value up to 75.

Commercial Auto Insurance. You can use the above calculator to estimate how much you can borrow based on your salary. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home.

A Buy to Let property sometimes referred to as buy to rent or BTL is a type of property investment in which the investor becomes a landlord and rents out the property for profit. Because interest rates and terms can vary depending on whether the property is an investment property or owner-occupied we have a commercial mortgage calculator for each scenario to give you the most accurate estimates possible. Our calculator includes amoritization tables bi-weekly savings.

Lets presume you and your spouse have a combined total annual salary of 102200. A mortgage calculator can help borrowers estimate their monthly mortgage payments based on the purchase price down payment interest rate and other monthly homeowner expenses. Please be aware that this is only an indication of how much you could borrow.

You can get a 100 commercial loan with equity in an existing property a guarantor business assets or a combination of all three. Self-directed RSP mortgages and mortgages on commercial properties are not eligible to be insured. Enter your details in the calculator to estimate the maximum mortgage you can borrow.

Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. Use the mortgage affordability calculator above to figure out how much you can afford to borrow based on your current situation. 801010 loans consist of a first mortgage 80 and a second mortgage 10 that total 90 of the purchase price and a 10 down payment.

As part of an affordability assessment lenders will check your credit. Lets say you took a 30-year fixed USDA loan worth 250000 at 3 APR. A commercial real estate appraisal can cost several thousands of dollars because there is so much input that is needed for a proper analysis.

A Buy to Let mortgage is a loan secured against one of these properties. The TD Mortgage Payment Calculator can help you better understand what your payments may look like when you borrow to buy a home. 15-Year Vs 30-Year Mortgage Calculator.

For example that youre buying a single-family home as your primary residence. Calculate how much you can borrow. Check out the webs best free mortgage calculator to save money on your home loan today.

The mortgage affordability calculator uses your salary details to give an idea of how much you may be able to borrow. Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value.

While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. How much house can I afford. The calculator uses sound mathematics to come up with the.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. Please enter the mortgage amount that you wish to borrow.

What is a Buy to Let mortgage. The following table compares the cost of making no down payment a 3 down and a 5 down on your loan. This mortgage payment calculator provides customized information based on the information you provide.

Loans 100000 to 250 million Larger loans can be considered. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Our commercial mortgage calculator will provide figures for both interest only and repayment mortgages.

How to use the mortgage affordability calculator. Mortgage adviser fees - Here. If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own.

This calculator also makes assumptions about closing costs lenders fees and other costs which can be significant. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. As rates rise so does the mortgage stress test.

See the average mortgage loan to income LTI ratio for UK borrowers. Please get in touch over the phone or visit us in branch. But ultimately its down to the individual lender to decide.

With todays announcement pushing variable rates up by 075 anyone who is getting a new variable-rate mortgage will need to pass a stress test that is 075 higher. The actual amount is based on a number of things including your salary credit rating and how much you can afford to repay after all your. But it assumes a few things about you.

Like any form of investment theres a lot to consider before you make the jump as. With a few key details the tool instantly provides you with an estimated monthly payment amount. Costs associated with getting a mortgage.

One of the reasons some people buy cash value life insurance is the potential to borrow money from the policy later on.

Auto Loan Calculator For Excel Car Loan Calculator Car Loans Loan Calculator

Bfiltqjc Ibeqm

Free Mortgage Calculator Free Financial Tools Transunion

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Loan Calculator That Creates Date Accurate Payment Schedules

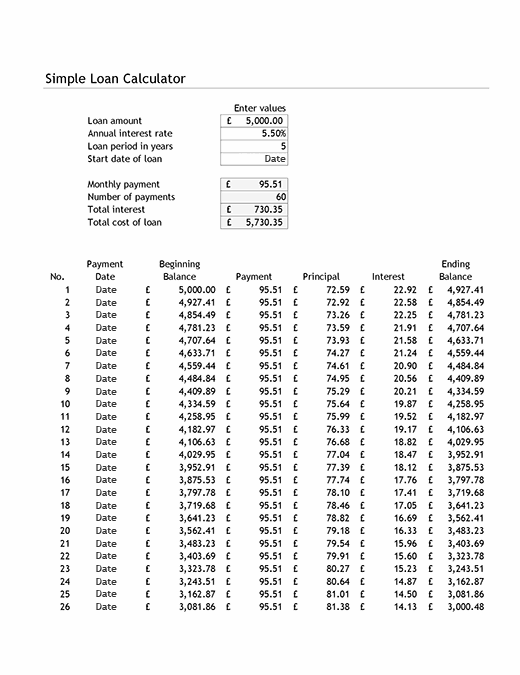

Simple Loan Calculator And Amortisation Table

Advanced Loan Calculator

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

Simple Loan Calculator

Mortgage Calculator How Much Monthly Payments Will Cost

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

Simple Mortgage Calculator

Free Interest Only Loan Calculator For Excel

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Loan Calculator Wolfram Alpha

Discount Points Calculator How To Calculate Mortgage Points

Mortgage Calculator How Much Monthly Payments Will Cost